Moon was the second of three failing car companies that killed the Ruxton. The Historic Vehicle Association profile of Moon says it was “faced with dwindling profits and further resistance from New Era Motors’ Archie Andrews who requested Moon begin building a more expensive luxury vehicle to be known as the Ruxton. Forcing the car into production and seizing control of the company, Andrew’s actions weakened the leadership of the Moon Motor Car Company.”

Not true – or even close to true.

In 1923, Moon had 500 dealers nationwide, serviced by distributors in 75 cities. It built assembled cars, sourcing components from others instead of building its own and was a success. But this business model ultimately put Moon at a disadvantage. With higher component costs than integrated manufacturers, Moon was unable to afford the technological innovations necessary to stay competitive a maturing automobile market. Then, in 1925, it introduced the Diana, a lower-priced eight-cylinder model targeting female customers.

Initially, the Diana was a success. Moon’s sales for 1925 were 10,271 automobiles. But then the warranty claims began flooding in. The cooling system Moon had designed was inadequate to cool the Diana’s engine, sourced from Continental. Engines over heated and damaged piston rings. Moon’s warranty costs tripled, and the company’s reputation suffered lasting damage.

Moon’s management then chose to undercut the its own distributors – the businesses that were the company’s real customers and had carried primary responsibility for promoting the Moon brand. In January of 1926, Moon announced it was bringing distribution of Moon automobiles in-house. Company owned distributors were established in major cities, including New York, Chicago, Atlanta, Kansas City, Milwaukee, and San Francisco. Its largest, most successful distributors were dropped.

Moon lost almost $1 million in 1926. About two-thirds of that – $624,060 – were losses from operating its company owned distributors. Moon abandoned company-owned distribution midway through 1927, but it continued losing money: $148,000 in 1927, $338,000 in 1928, and $277,000 in 1929. By 1929, its total production had collapsed to 1,333 automobiles.

Today, we would recognize Moon Motor Car Company as a classic takeover target. It had assets but could not cover its operating costs.

In November of 1929, the Chairman of Moon’s Board of Directors, Stewart McDonald, agreed with Stanley Moon, who was both a company officer and McDonald’s brother-in-law, that McDonald would engineer a loan to Moon Motor Car Company from Archie Andrews if Stanley Moon would help McDonald divorce Grace Moon. (The divorce was granted the next year.) Andrews did not make a loan to Moon.

Instead, Andrews negotiated a production agreement with Moon. Under the agreement, New Era assigned Ruxton production rights to Moon. Moon issued 150,000 shares of Moon stock to New Era and agreed to issue another 100,000 shares that would be sold on the open market to finance manufacturing the Ruxton. Nothing in the agreement precluded Andrews from acquiring that 100,000 shares – and he did purchase most of them. Andrews and New Era then owned 239,000 of the 350,000 total outstanding shares of Moon stock.

Archie Andrews was serious about building the Ruxton. He worked to build a market for it, promoting it with full-size multiple page advertisements in Life Magazine, then one of the most popular weeklies in the United States. He engaged Joseph Urban to design color schemes that accentuated the inherent lowness of the Ruxton’s design, simultaneously calling attention to its unique design and setting it apart from ordinary automobiles. He had no reason to trust the success of his dream car to Moon’s inept, self-dealing management.

Moon’s management had not anticipated that New Era would end up controlling the company. They refused to recognize the new owner’s rights and barricaded themselves inside the Moon factory. They were evicted by court order.

According to Muller’s later comments, New Era then discovered the Moon factory was in much worse condition than its management had led Andrews and New Era to believe. Moon’s plant completely lacked the ability to produce the transaxle that was the Ruxton’s key component.

This led Andrews to the Kissel Motor Car Company.

Kissel, too, was a company with no future.

Kissel was the third of three failing car companies that killed the Ruxton.

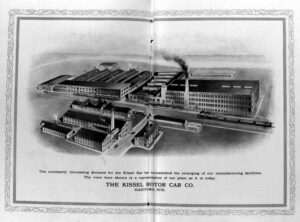

Organized in 1906, the Kissel Motor Car Company was owned by the Kissel family. Kissel had produced some glamorous models: the “Gold Bug,” a high-priced roadster that is today considered a full classic, is the most famous. However, in its best year Kissel had manufactured only 6,000 automobiles and sales had been declining since the mid-1920’s. A 1929 redesign had not helped. Kissel began producing taxicabs and funeral cars, but that had not been enough to return the company to a profit. In early 1929, Kissel had been forced to borrow $200,000 at a higher-than-market interest rate to finance continuing operations.

What Kissel did have was the ability to manufacture the Ruxton transaxle.

After an initial agreement with New Era, the transaxle tooling was moved to Kissel’s plant. The Moon plant, however, was in dismal condition. It made sense to tap into Kissel’s plant capacity by contracting it to build the entire automobile, not just the transaxles. That would give New Era two assembly plants, spreading its bets.

In March of 1930, New Era reached an agreement for Kissel to manufacture the Ruxton.

The terms of that agreement display Kissel’s desperate financial condition. George Kissel, who was president of the company and personally guaranteed the contract, was literally betting the company on its 1930 sales.

In exchange for an immediate $100,000 loan from New Era and a commitment for another $150,000 loan to be made later, Kissel agreed to produce 1,500 Ruxtons annually, contingent only upon the market being able to “absorb” that volume. This portion of the agreement was one-sided. It committed New Era to nothing. Kissel was promised that it could produce 1,500 Ruxtons per year only if New Era could sell them. New Era, however, was not promising it would, or could, sell them.

Kissel, in contrast, was making a very important and risky commitment. In the agreement, Kissel guaranteed it would produce five Kissel automobiles, one funeral car, and one taxicab daily for the remainder of the year. Should Kissel fail to meet these terms, the Kissel family agreed to assign their common stock in the Kissel Motor Car Company to New Era in exchange for preferred shares of New Era stock. Common stock votes. Preferred stock does not. If this clause were triggered, the Kissel family would be required to give control of Kissel Motor Car Company to New Era and Archie Andrews.

One-sided though it was, the terms of this contract were entirely reasonable from New Era’s perspective. New Era was not acquiring Kissel. It was hiring Kissel to build cars for New Era. New Era would need to build a dealer network simultaneously as it ramped up Ruxton production. Kissel’s plant was mortgaged. New Era needed to be sure Kissel could support itself until Ruxton production was able to support it. If Kissel failed to pay its mortgage, it would be out of business and the Kissel plant would go to its creditors. The production quota clause clearly was intended to allow New Era to take control before Kissel collapsed.

George Kissel lost his bet.

Kissel had produced only 1,071 vehicles in 1929. To meet the terms of the agreement, Kissel would need to produce more than 1,300 Kissel automobiles, taxicabs and funeral cars during the remainder of 1930, in addition to any Ruxton production.

Kissel produced only 261 automobiles in 1930.

By September of 1930, unable to meet the mortgage payments on its plant and facing foreclosure, Kissel invited a friendly receivership, a form of state court reorganization for the benefit of creditors. With Kissel in receivership, Ruxton transaxle production ended, forcing Moon to stop production. Within two months, Moon was in receivership and New Era had filed for bankruptcy. New Era’s largest creditor was Archie Andrews and his investment company.

Andrews did not kill Kissel. At George Kissel’s direction, Kissel committed hari-kari.

George Kissel blamed Andrews for the failure of the company because New Era had not made the further $150,000 loan. Andrews claimed New Era could not raise the money in the dismal 1930 stock market.

Neither claim stands up to scrutiny.

George Kissel oversaw the Kissel Motor Car Company right to the end. The decline of the company was the fault of its management, not Archie Andrews. Kissel had already run through the $100,000 loaned by New Era in March. Six months later, it couldn’t pay its mortgage. Loaning Kissel another $150,000 would have provided funds for a few more mortgage payments, but Andrews and New Era were going to get the company on December 31st – regardless. There was no chance Kissel could meet the production commitment of its agreement with New Era.

However, there is no reason to believe Andrews could not have raised the money required of New Era in its loan commitment to Kissel. Andrews claimed he lost a fortune in the “crash” and rebuilt it later – but that’s not the same as saying he wasn’t still wealthy or that he didn’t have access to funds. He may have lost a lot, but he still had a lot. He was spending almost as much on annual upkeep for his yacht as New Era had promised to loan to Kissel.

So, why did Andrews let Kissel fold?

Had New Era made the loan, it could have prevented foreclosure. No receiver would have taken possession of the Kissel plant. That plant and its equipment would have come under New Era’s control as a result of Kissel failing to meet the production quota clause. New Era would have had everything needed to assure production of the Ruxton.

So, why didn’t New Era make the loan?

It may be that George Kissel outsmarted and blindsided Archie Andrews. By arranging the receivership, George Kissel ultimately retained family control of the company. As it would develop, the court-appointed receiver would bring George Kissel back to run the company in receivership. George Kissel would ultimately reorganize the company and buy its assets out of that receivership. The company would survive under family control, though not manufacturing automobiles. (For more about Kissel, see our post about the Wisconsin Automotive Museum in Hartford, Wisconsin.)

It may also be that Archie Andrews elected to cut his losses.

Andrews had been assessing markets since he first sold unlisted securities at age 21. He had seen the opportunity presented by the Budd prototype in 1928. When he had organized New Era in 1929, the country was prosperous, the market for new automobiles was strong, and front wheel drive was the technology of the future.

But the six months between March and September of 1930 had destroyed any hope that the economy would soon recover its former prosperity. Unemployment had almost tripled. Gross national product would fall 9.4 percent for the year. Automobile sales were dropping drastically. Ford sales dropped 25% in 1930 and would drop almost 50% more in 1931. Packard sales dropped from 47,855 in 1929 to 34,445 in 1930.

The time for the Ruxton had passed before Andrews could bring it to the market. Auburn had introduced the Cord L-29 in late 1929 and publicity associated with the model’s poor traction on hills was dimming the luster of front wheel drive. Established manufacturers of higher priced automobiles were struggling and New Era still did not have a dealer network. It was even less likely to find one now. Pouring another $150,000 into Kissel to save the Ruxton would have been wasting the money. The Ruxton was no longer a viable business proposition.

Archie Andrews made no effort to rescue New Era or the Ruxton from the consequences of Kissel’s collapse. The delays caused by three failing car companies had killed the Ruxton.

He moved on.

But he didn’t forget about Hupp.

In 1934, Archie Andrews attempted to take control of the Hupp Motor Car Company and oust its management. He was elected Chairman of the Board of Directors. Despite Andrews having substantial shareholdings in Hupp, the existing management fought him with a vigor they had not once exhibited toward selling Hupmobiles.

Claiming to represent all other shareholders, J. Walter Drake – who was one of Hupp’s original investors and its former President – filed a class action lawsuit in March of 1935 against Hupp and Andrews. Drake was, however, really a stand-in for Hupp’s management, including DuBois Young. As Hupp’s president, Young had presided over the collapse of Hupmobile sales while the company’s accumulated losses reached $15 million. Nonetheless, Drake had the audacity to claim Andrews had impaired Hupp’s credit, causing suppliers to accept cash only. Drake also claimed Andrews was guilty of self-dealing because Andrews had arranged, as part of his compensation, stock options contingent on Hupp achieving profits for a period of six months and again when profits exceeded a total of $1 million.

Today, of course, stock options based on performance are a normal form of executive compensation. Certainly, Hupp was risking nothing in the deal with Andrews – he either sold cars or he didn’t get the stock. But Hupp’s management wasn’t interested in selling Hupmobiles. They were only interested in preserving their positions. They did not want to run the risk that Andrews would meet the option terms and increase even further his holdings of Hupp stock.

It was a classic example of entrenched management fighting a takeover and dooming the company in the process. The federal appellate court, nonetheless, ruled for Drake and his colleagues, stating that “[t]he history of Hupp and its management prior to the time the [lawsuit] arose . . . [is] beside the point.” It held the contracts with Andrews were not properly ratified by the board of directors because the notice of the special meeting of shareholders approving them was not sufficiently specific to satisfy requirements in Hupp’s articles of incorporation. The court’s decision put the old management back in charge of Hupp.

With these people back in charge, Hupp continued its death spiral. Hupp again hired Raymond Lowey to design a new “Aero-Dynamic” Hupmobile for 1934. It did not sell. The 1935 model did no better. With the company’s cash exhausted by years of losses, Hupp was forced to sell plants and other assets in 1936. It again redesigned its models for 1938. However, Hupp’s dealer network had dissolved. It sold only 1,886 Hupmobiles. Hupp joined with Graham in 1939 to produce an automobile using Cord 810/812 tooling, but only 319 of these Hupmobile Skylarks were manufactured, assembled in the Graham plant.

Hupp was out of the automobile business.

Archie Andrews did not kill Hupp. Hupp’s management, led by DuBois Young, “ran it into the ground.” They missed their golden opportunity by rejecting the Ruxton and blew their last chance by fighting Andrews. Hupp died in the depression. But the cause of death was the company’s management from 1925 onward.

Andrews did not pursue ventures in the automobile industry after Hupp. He served as Chairman of the Board of Dictagraph Production Company. In that capacity, he made Dictagraph successful with production of an electric shaver. Dictograph was sued by Schick Dry Shaver, Inc. for patent infringement in federal court. As Dictograph’s chairman, Andrews fought the case and won.

After Andrews death, one of the appellate court judges that had decided the Dictograph case was indicted for taking bribes. The indictment named Andrews as an unindicted co-conspirator with the judge, claiming that he had paid a bribe in the Dictagraph case. Andrews, of course, had no chance to defend that accusation and the appellate court that rejected the judge’s appeal from his conviction explained that the bribes had not changed the outcomes of any cases. As portrayed by the appeals court, the judge was engaged in a ”shake-down” scheme soliciting bribes from litigants he knew, as one of the three judges deciding a case, had already won. He took advantage of the interval between the court’s decision and the time, sometime months later, the decision would be announced. Andrews certainly had a defense – that he was a victim, not a conspirator.

Andrews is under-appreciated today. The Ruxton is his legacy. The nineteen remaining are full classics, automobiles that provide a vision of what might have been, automobiles ahead of their time, as was the man who tried repeatedly to bring the Ruxton to production.

Archibald Moulton Andrews was a man who saw the future and tried to create it in the present.

He should be remembered that way.

(THIS POST WAS CONTINUED FROM PART ONE.)